Direct-to-Patient Platforms: An Emerging Inflection Point for Biopharma Distribution

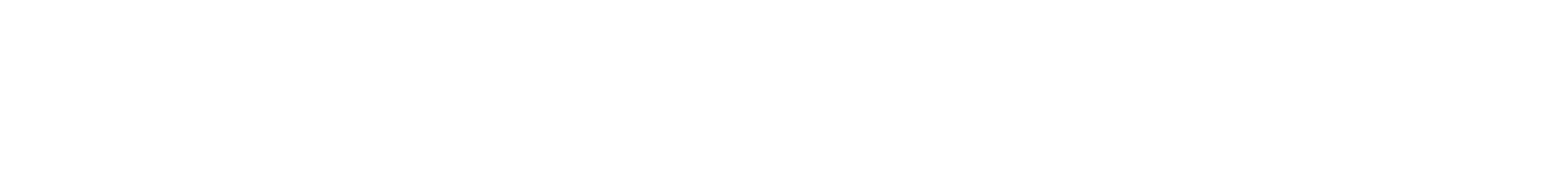

Pharmaceutical distribution in the United States has traditionally relied on a complex, intermediary-driven model. Manufacturers negotiate rebates with pharmacy benefit managers (PBMs), PBMs influence formulary placement and coverage, and pharmacies dispense medications to patients. While this system has enabled broad access, it has also contributed to opaque pricing, administrative burden, and rising out-of-pocket costs –particularly for patients whose medications are not covered by insurance or are subject to utilization-management requirements. In many cases, biopharma economics, and ultimately patient economics, are directly – and negatively – impacted by the current system.

Over the past two years, growing frustration with these challenges has prompted biopharma companies to explore alternative distribution pathways. Direct-to-patient (DTP) platforms – once viewed as niche or experimental – are now emerging as a viable alternative to traditional channels. Building on the momentum of the GLP-1 space and beyond, companies including Eli Lilly, Pfizer, Novo Nordisk, and Amgen have all introduced DTP platforms. This shift reflects intensifying competition, evolving patient expectations, biopharma companies’ desire to expand access for the patients they serve, and policy momentum aimed at lowering drug prices and increasing transparency.

What Are DTP Platforms – and What Do They Offer?

DTP platforms broadly refer to distribution models that allow manufacturers to engage patients more directly, reducing reliance on PBMs and traditional pharmacy networks. These models take multiple forms. Some are manufacturer-owned digital ecosystems that integrate telehealth, prescribing, affordability support, and home delivery (e.g., LillyDirect). Others involve external online pharmacies that purchase products directly from manufacturers and sell them to patients at transparent, cash-based prices (e.g., Cost Plus Drug Company).

For patients, DTP platforms can offer meaningful benefits: lower out-of-pocket costs for self-pay medications, fewer administrative barriers such as prior authorization for cash-pay prescriptions, consolidated medication management, home delivery, and access to telehealth services for appropriate use cases. DTP models also allow manufacturers to compete with compounding pharmacies by offering FDA-approved products at more accessible price points.

From the manufacturer perspective, DTP platforms can materially alter distribution economics. By reducing rebates and fees paid to intermediaries, companies may lower net costs while gaining direct visibility into patient access and adherence. Direct engagement also enables manufacturers to retain first-party patient insights that are typically lost within traditional pharmacy channels, supporting more informed patient-support strategies and longer-term lifecycle planning.

Why DTP…and Why Now?

The acceleration of DTP platforms reflects a convergence of market, policy, and behavioral forces.

The Rise of Compounding

Compounding pharmacies have become an influential part of the DTP pharmaceutical market by selling low-cost medication directly through digital platforms when branded therapies are expensive or difficult to access. Traditionally, compounding pharmacies were used to prepare customized, patient-specific medications from scratch when commercially available products could not meet an individual’s clinical needs. Compounding companies today have evolved to become much more than that. Companies such as Hims & Hers and Ro have expanded this model by integrating virtual care with fulfillment, offering medications for conditions such as erectile dysfunction, hair loss, mental health, and weight management through seamless online telehealth experiences. These pharmacies have helped normalize online prescription purchasing and created competitive pressure for branded manufacturers, particularly in high-demand categories, accelerating the push toward manufacturer-led DTP platforms using FDA-approved products.

Policy Change

Public scrutiny of PBMs and drug pricing has intensified, with policymakers signaling interest in steering patients toward lower-cost purchasing options and greater price transparency. TrumpRx, February 5th, aims to direct patients to platforms that offer clearer pricing and affordability options.

Evolving Patient Behavior

Growing competition in categories such as obesity has reshaped patient behavior, with GLP-1 therapies normalizing the idea that patients can search for, compare, and purchase prescription medications online. However, this shift reflects a broader movement toward on-demand care, driven in part by younger generations who are less likely to have established primary care relationships and are more comfortable engaging with healthcare digitally. The rapid expansion of telehealth during the COVID-19 pandemic further accelerated these behaviors, reinforcing expectations around convenience, speed, and accessibility. Advances in telehealth, e-prescribing, and logistics have made DTP models operationally feasible, creating a window in which these platforms are both timely and strategically attractive.

DTP Marketplace Evolution

Beginning with LillyDirect in 2024, manufacturer utilization of DTP platforms has been slowly but steadily increasing. This increase, alongside the continued expansion of digital pharmacies, access platforms, and other intermediaries, is quickly diversifying the biopharma DTP landscape. There have been several notable manufacturer-owned DTP platform additions, particularly in high-demand categories.

- LillyDirect, launched in January 2024, was among the first platforms to reach scale. After expanding in August 2024 to include lower-cost single-use vials of Zepbound (tirzepatide) for self-pay patients, Lilly reported that by mid-2025 approximately one-third of new Zepbound prescriptions were being filled through the platform – signaling that DTP had become a meaningful access channel rather than a niche experiment.

- Pfizer followed suit by launching PfizerForAll in August 2024 to help patients access treatments like Nurtec (rimegepant) for migraines and Paxlovid (nirmatrelvir ritonavir) for COVID-19. This platform expands patient access by offering services like telehealth appointments and diagnostic tests.

- Novo Nordisk then followed with the launch of NovoCare Pharmacy in March 2025, enabling eligible self-pay patients to receive Wegovy (semaglutide) via direct home delivery at a reduced cash price. Early reporting indicates strong patient uptake, reinforcing the role of direct purchasing options in expanding access.

- Amgen entered the space in October 2025 with AmgenNow, initially offering Repatha (evolocumab) at a discounted monthly cash price. While platform-specific volumes have not been disclosed, Amgen reported strong year-over-year growth in Repatha sales following expanded affordability initiatives.

Taken together, these examples suggest that DTP platforms can meaningfully impact patient access and treatment utilization, particularly where affordability and convenience are key drivers.

Beyond manufacturer-owned platforms, a broader ecosystem of digital pharmacies and access tools is reinforcing the shift toward consumer-centric distribution.

- TrumpRx is designed as a pricing and navigation portal rather than a dispensing pharmacy. Its goal is to direct patients – particularly seniors and uninsured or underinsured individuals – to lower-cost purchasing options across manufacturer DTP platforms and online pharmacies, increasing transparency and competitive pressure.

- GoodRx continues to evolve beyond coupons and price comparison, introducing cost-plus pricing arrangements through its Community Link program and signaling interest in participating in TrumpRx.

- BlinkRx operates as an enabling partner for manufacturers, offering turnkey fulfillment, logistics, and patient engagement services that lower barriers to launching DTP programs.

- Other players – including the Mark Cuban Cost Plus Drug Company and Amazon Pharmacy – are expanding cash-pay and transparent pricing models, further normalizing online prescription purchasing and consumer choice.

Collectively, these platforms vary in structure but contribute to a broader trend toward flexibility, price transparency, and patient empowerment.

Risks, Limitations, and Open Questions

Despite their promise, DTP platforms are not without limitations. While important for ensuring that appropriate guardrails are in place, – including telemedicine compliance, e-prescribing standards, and data privacy – add operational complexity. Some regulatory officials and lawmakers have raised concerns that manufacturer-linked DTP telehealth platforms could steer patients toward specific, high-cost branded products without adequate oversight, citing potential conflicts of interest, Anti-Kickback Statute risk, and past examples of elevated prescribing rates without independent clinical evaluation.

Launching and sustaining a DTP channel also requires meaningful investment, which may be challenging for smaller companies. In addition, for products that are well covered by insurance, traditional benefit designs may continue to offer lower out-of-pocket costs than cash-pay DTP options, potentially limiting uptake. To date, much of the visible success has been concentrated in the GLP-1 category, raising open questions about how scalable and economically viable DTP models will be across other therapeutic areas.

From a patient perspective, DTP platforms also present important considerations around care experience and continuity. Telehealth-first models may be insufficient for patients with complex or unstable conditions that require ongoing, in-person clinical oversight. As more manufacturers launch standalone DTP platforms, patients – particularly those managing multiple medications – may be required to navigate multiple portals, prescribing workflows, and delivery schedules. This fragmentation can quickly undermine convenience and adherence, suggesting that long-term DTP success will depend not only on access and affordability, but on how well these models support a seamless, holistic medication experience.

Looking Ahead

While the future of DTP platforms may be uncertain, their role in the biopharma landscape appears durable. Some established market stakeholders are responding with pricing reforms, while new models – such as direct-to-employer contracting – are gaining traction. Both Eli Lilly and Novo Nordisk have begun selling GLP-1 therapies directly to employers, offering another mechanism to reduce intermediaries while improving access.

Patient behavior continues to evolve. Consumers are increasingly learning how to search and shop online for pharmaceuticals, much as they once adapted to ordering groceries or clothing digitally. As these behaviors mature, patient expectations around convenience, transparency, and coordination across medications are likely to influence which DTP models gain traction. Platforms that simplify access and fit naturally into patients’ broader care journeys may be better positioned to scale, while those that create friction or fragmentation risk losing relevance as the market evolves.

Taking Action Amidst This Evolving Landscape

Direct-to-patient platforms are not a universal solution, but they represent a meaningful evolution in how biopharma companies approach access, affordability, and patient experience. As competition intensifies and pressure around drug pricing persists, DTP models offer manufacturers new ways to engage patients more directly, test pricing transparency, and reduce reliance on traditional intermediaries.

For biopharma leaders, the strategic question is no longer whether DTP platforms belong in the future distribution landscape – but where, how, and for which patients they create the most value.

So, What Can You Do?

- Build fluency in the DTP ecosystem: Understand how manufacturer platforms, digital pharmacies, employers, and compounding providers fit together – and how patients are navigating across them.

- Assess where, and if, DTP fits your portfolio: Evaluate which products, populations, and access barriers could realistically benefit from direct distribution.

- Extend convenience into more complex treatments: Explore how DTP models could evolve beyond lifestyle and primary care into more complex disease areas with specialized support needs.

- Take a patient-first approach: Consider the full patient journey across medications and platforms, and prioritize simplicity, coordination, and continuity of care to avoid creating a fragmented experience.

- Treat DTP as a strategic capability: View direct distribution not as a one-off channel experiment, but as a core lever within long-term access and commercialization strategy.

References

Amgen Inc. (2025). Amgen makes Repatha available through AmgenNow, a Direct-to-Patient program in the U.S. https://www.amgen.com/newsroom/press-releases/2025/10/amgen-makes-repatha-available-through-amgennow-a-directtopatient-program-in-the-us

Business Wire. (2025). BlinkRx launches Operation Access Now. https://www.businesswire.com/news/home/20250807070685/en/BlinkRx-Launches-Operation-Access-Now-to-Accelerate-and-Scale-DirecttoPatient-and-DirecttoBusiness-Programs

CBS News. (2025). Novo Nordisk slashes out-of-pocket prices for Wegovy and Ozempic for some customers. https://www.cbsnews.com/news/novo-nordisk-cuts-out-of-pocket-price-wegovy-ozempic/

Drug Channels Institute. (2025). Direct-to-consumer models: Why they’re expanding and where they deliver the most impact.

https://www.drugchannels.net/2025/03/direct-to-consumer-models-why-theyre.html

Durbin, R. J., Warren, E., & Welch, P. (2025). Following Big Pharma’s troubling schemes with DTC telehealth platforms, lawmakers sound alarm on launch of TrumpRx. U.S. Senate Press Release. https://www.durbin.senate.gov/newsroom/press-releases/following-big-pharmas-troubling-schemes-with-dtc-telehealth-platforms-durbin-warren-welch-sound-alarm-on-launch-of-trumprx

Eli Lilly. (2024). Lilly launches end-to-end digital healthcare experience through LillyDirect. https://investor.lilly.com/news-releases/news-release-details/lilly-launches-end-end-digital-healthcare-experience-through

Eli Lilly. (2025). Q2 2025 earnings call. https://investor.lilly.com/events/event-details/q2-2025-earnings-call

Endpoints News. (2025). Amgen joins Trump’s DTC push, will offer Repatha at 60% list price discount.

https://endpoints.news/amgen-joins-trumps-dtc-push-will-offer-discounted-repatha/?u=3a9fe10a-85dc-49e7-8f38-caf627640ea4&s=email&c=524130ce-4122e5e4-357872bd&utm_medium=email&utm_campaign=910%20-%20Trump%20admin%20pares%20back%20FDA-university%20collabs%20Amgen%20joins%20Trump%20DTC%20push%20Enterprise&utm_content=910%20-%20Trump%20admin%20pares%20back%20FDA-university%20collabs%20Amgen%20joins%20Trump%20DTC%20push%20Enterprise+CID_0a1446d67225585b6b770fe23403501b&utm_source=ENDPOINTS%20emails&utm_term=Amgen%20joins%20Trumps%20DTC%20push%20will%20offer%20Repatha%20at%2060%20list%20price%20discount

Endpoints New. (2025). Goodbye, Middleman. Hello, Littleman.

Endpoints News. (2025). More than a third of Lilly’s new Zepbound prescriptions are coming from DTC program.

https://endpoints.news/more-than-a-third-of-lillys-new-zepbound-prescriptions-are-coming-from-dtc/?u=3a9fe10a-85dc-49e7-8f38-caf627640ea4&s=email&c=107e23d7-f55ae37e-81007427&utm_medium=email&utm_campaign=The%20DTC%20market%20for%20obesity%20drugs%20heats%20up%20Enterprise&utm_content=The%20DTC%20market%20for%20obesity%20drugs%20heats%20up%20Enterprise+CID_84ec1ead01ff0b8c6bc7049fc8c90648&utm_source=ENDPOINTS%20emails&utm_term=More%20than%20a%20third%20of%20Lillys%20new%20Zepbound%20prescriptions%20are%20coming%20from%20DTC%20program

Endpoints News. (2025). Novo Nordisk’s direct-to-patient platform gains momentum as self-pay sales rise.

https://endpoints.news/novo-nordisks-direct-to-patient-platform-gains-momentum-as-self-pay-sales-rise/?u=3a9fe10a-85dc-49e7-8f38-caf627640ea4&s=email&c=107e23d7-f55ae37e-81007427&utm_medium=email&utm_campaign=The%20DTC%20market%20for%20obesity%20drugs%20heats%20up%20Enterprise&utm_content=The%20DTC%20market%20for%20obesity%20drugs%20heats%20up%20Enterprise+CID_84ec1ead01ff0b8c6bc7049fc8c90648&utm_source=ENDPOINTS%20emails&utm_term=Novo%20Nordisks%20direct-to-patient%20platform%20gains%20momentum%20as%20self-pay%20sales%20rise

Fierce Pharma. (2025). Amgen unveils DTC platform with 60% discount on Repatha, giving US lowest price of G7 nations. https://www.fiercepharma.com/marketing/amgen-unveils-dtc-platform-60-discount-repatha-giving-us-lowest-price-g7-nations

Forbes. (2025). Trump’s pharma agreements signal a shift toward direct-to-consumer pricing. https://www.forbes.com/sites/ritanumerof/2025/11/01/trumps-pharma-agreements-signal-a-shift-toward-direct-to-consumer-pricing/

GoodRx. (2025). GoodRx launches Community Link to offer independent pharmacies cost-plus pricing. https://investors.goodrx.com/news-releases/news-release-details/goodrx-launches-community-link-offer-independent-pharmacies-cost?mobile=1&mobile=1&mobile=1&mobile=1

Hims & Hers Health, Inc. (2024). Form 10-K and company overview. https://investors.hims.com

Industry Informant. (2025). GoodRx wants in on TrumpRx as it grows its work with manufacturers.

https://industryinformant.com/goodrx-wants-in-on-trumprx-as-it-grows-its-work-with-manufacturers/

JAMA Network Open. (2023). Benefits and limitations of direct-to-consumer pharmacies in the U.S. https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2837772

Mark Cuban Cost Plus Drug Company. (2023). Our mission and pricing model.

https://www.costplusdrugs.com/mission/

Mark Cuban Cost Plus Drug Company. (2024). Official website. https://costplusdrugs.com

Pfizer Inc. (2024). Pfizer launches PfizerForAll™, a digital platform that helps simplify access to healthcare. https://www.pfizer.com/news/press-release/press-release-detail/pfizer-launches-pfizerforalltm-digital-platform-helps

PharmaVoice. (2024). Pfizer and Lilly’s telehealth prescribing platforms draw Senate scrutiny for ‘potential fraud’. https://www.pharmavoice.com/news/pfizer-lilly-telehealth-senate-letter-dtc/732428/

Reuters. (2026). Amazon Pharmacy starts offering Novo Nordisk’s Wegovy weight-loss pill. https://www.reuters.com/business/healthcare-pharmaceuticals/amazon-pharmacy-offers-novo-nordisks-wegovy-pill-2026-01-09/

Reuters. (2025). Lilly, Novo Nordisk back direct-to-employer programs to expand access to weight-loss drugs. https://www.reuters.com/business/healthcare-pharmaceuticals/novo-lilly-collaborate-with-waltz-health-sell-weight-loss-drugs-directly-2025-11-21/

Reuters. (2025). Lilly offers weight-loess drugs in vials at a discount to fight competition. https://www.reuters.com/business/healthcare-pharmaceuticals/lilly-launches-higher-dose-vials-weight-loss-drug-150-less-than-injector-pen-2025-02-25/

Reuters. (2025). Novo Nordisk to sell Wegovy through telehealth firms to cash-paying U.S. customers. https://www.reuters.com/business/healthcare-pharmaceuticals/hims-hers-partners-with-novo-nordisk-sell-wegovy-its-platform-2025-04-29/

Reuters. (2024). Pfizer launches new website for migraine, respiratory offerings. https://www.reuters.com/business/healthcare-pharmaceuticals/pfizer-launches-new-website-migraine-respiratory-offerings-2024-08-27/

Ro. (2024). How Ro works: Telehealth and online pharmacy model. https://ro.co/roman/how-it-works/

Sidley Austin LLP. (2024). Life sciences partnerships with telemedicine platforms invite new congressional scrutiny. https://www.sidley.com/en/insights/newsupdates/2024/11/life-sciences-partnerships-with-telemedicine-platforms-invite-new-congressional-scrutiny

STAT News. (2025). Novo Nordisk to sell obesity drug Wegovy direct to patients at lower price. https://www.statnews.com/2025/03/05/novo-nordisk-wegovy-lower-price-obesity-drug/

Stop Obesity Alliance. (2024). Compounding of GLP-1 drugs. https://stop.publichealth.gwu.edu/LFD-oct24

U.S. Chamber of Commerce. (2023). How online pharmacies from Mark Cuban to Amazon are unlocking growth opportunities for startups and businesses alike.

https://www.uschamber.com/co/good-company/launch-pad/online-pharmacies-unlocking-growth-for-startups-and-legacy-businesses

U.S. Food and Drug Administration. (2023). Compounded drugs and regulatory oversight. https://www.fda.gov/drugs/human-drug-compounding/human-drug-compounding-policies-and-rules