The past few months have been marked by a flurry of announcements and sweeping policy proposals from the current administration around drug pricing and pharmaceutical regulation, including the resurfacing of ‘most favored nation’ pricing for the US. This follows a decade of growing pressure from across the political spectrum to lower drug prices in the US, which the pharma industry has largely withstood to date by making the case that such changes would have a significant detrimental impact on US-led innovation.

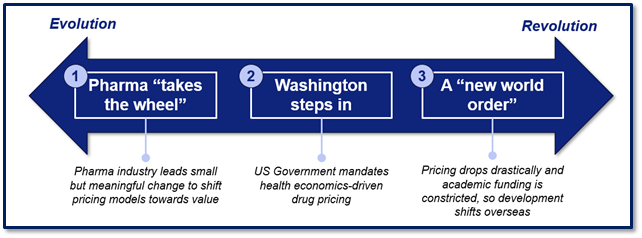

The recent proposal from the Trump administration advocating for ‘most favored nation’ pricing represents one of the strongest signals yet of mounting pressure on drug pricing. While such policy announcements don’t always materialize as initially presented, and this one faces real hurdles to implement, it highlights a broader trend: meaningful change is coming to the US drug pricing landscape. The nature of that change – whether incremental or transformative – remains uncertain. Depending on how industry and policy stakeholders respond to the growing pressure, we see three primary scenarios that could unfold:

- Pharma “takes the wheel,” leading evolutionary but meaningful change towards real and perceived pricing / value alignment

- Washington steps in, driving more significant change through health economics / technology assessments

- A “new world order” emerges, in which drastic reduction in US drug pricing, coupled with a severe deficit in academic research funding, leads to the loss of US leadership in pharmaceutical innovation

Pharma “takes the wheel”

This path is predicated on the pharma industry taking broader, proactive steps to evolve its pricing models, pre-empting government mandated price reductions. We see this as a world in which pharma companies consistently and directly align drug pricing to value. Robust, health economics-based pricing models and industry partnership with trusted third-party entities (e.g., ICER) become the norm, leading to greater trust and transparency in drug pricing. More direct price / value alignment and greater price transparency set the stage for less opaque contracting and formulary placement and the reduction of hidden costs associated with our current PBM-based system. While drug pricing in this scenario comes down on average, innovation that delivers meaningful value to patients is still rewarded with fair returns.

Washington steps in

If pharma companies do not lead with sufficiently meaningful change, the US government could step in with mandated pricing assessments. In this world, Congress legislates new frameworks that more closely tie drug reimbursement rates to clinical and economic evidence. For example, the government could standardize the use of Health Technology Assessments (HTAs), similar to those currently used in the European Union, to set pricing based on government-defined criteria. In principle, truly innovative drugs with demonstrable value would still command pricing premiums under an HTA-like pricing mechanism. However, with government-led vs. industry-led assessments, we expect value-assessments in the US to more closely approximate assessments in other markets. As a result, US pharma companies may begin to regionalize their portfolios to harmonize pricing and value-demonstration investments globally.

A “new world order” emerges

If ‘most favored nation’ pricing in the US does play out in a form similar to what is being proposed, and the recent pullback on government funding for scientific research continues, we see a more fundamental shift in global pharma industry dynamics taking place. The significant reduction in incentives for innovation and the lack of support for early-stage research leads companies to shift their R&D investments overseas to regions with more favorable clinical development economics. The US, once the trailblazer of the life sciences industry, now becomes a secondary market, no longer driving global launches of innovative products, but rather receiving products developed abroad. The US life sciences ecosystem loses its leadership role in driving cutting-edge research, and the center of gravity for pharmaceutical innovation shifts overseas.

Conclusion

While the path forward is unclear, the current policy swirl can serve as a call to action for the pharma industry to take a more proactive stance in shaping a future where bipartisan concerns about drug pricing are addressed while preserving US global leadership in life sciences innovation.